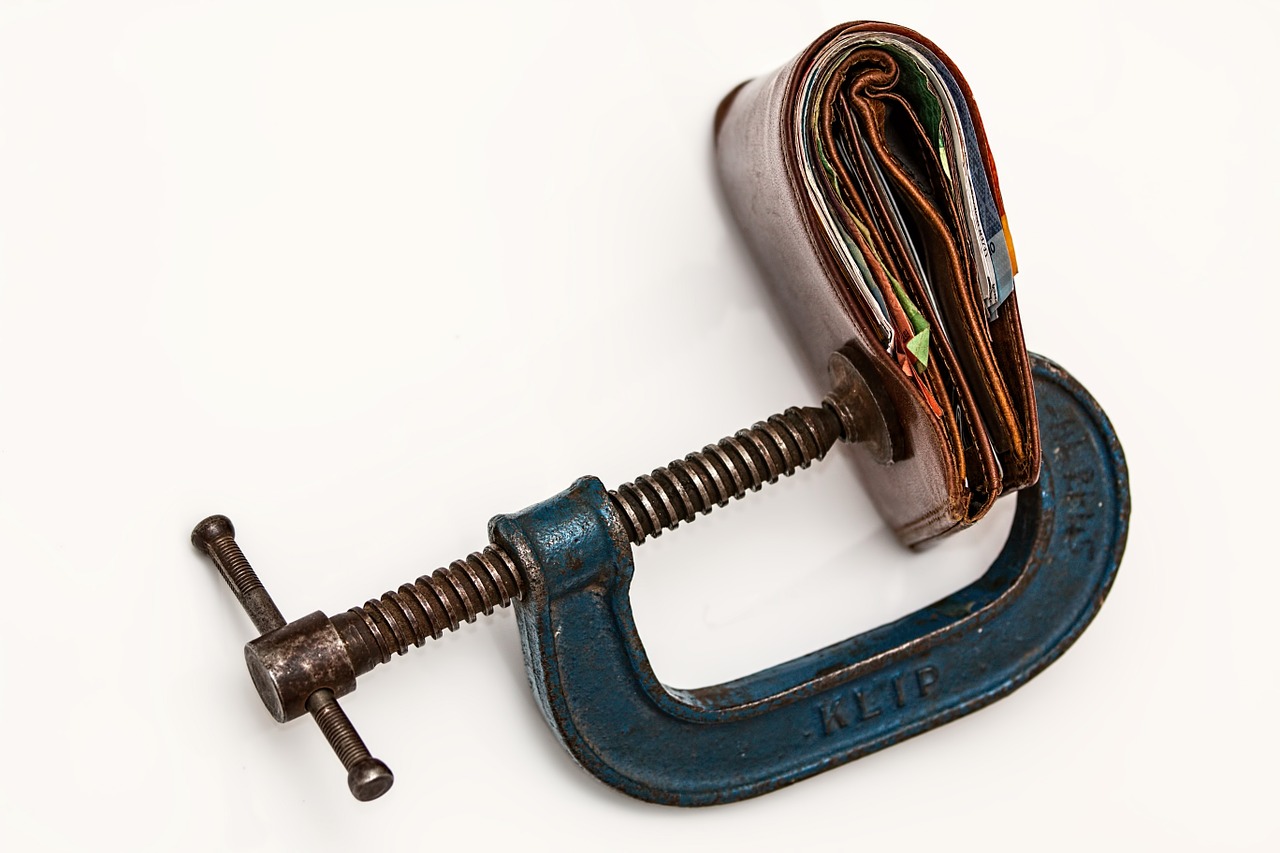

Suddenly you need 10000USD for a sudden and unexpected expense and your bank account is empty? You will probably have to use bank credit. A 10K loan is available from all banks in the USA. It is also the amount we can get as a parabank loan. So you can say that it is a loan that is quite easily available for customers. In order to obtain it, we will only have to show a relatively high monthly income.

How to get a loan of $10,000?

To get a cash loan for $10,000 we will have to fill in a loan application on the bank’s website. After verifying the information provided therein, the bank will be able to make a positive or negative credit decision. One of the main criteria that the bank will take into account will be the amount of our earnings and the source of their acquisition. In order to obtain a loan of USD 10,000, we will have to show net earnings at the level of almost USD 3,000 and not too large current financial liabilities. If we meet these conditions, the bank will be able to consider that we will be able to repay the loan without any problems. A positive credit history in the office will also be important. The BIK database gathers all information on the timely repayment of our old loans. If we had any problems with this, then in the case of a loan application for the amount of 10,000 USD, the bank’s decision will probably be refused.

Comparison of offers of several banks

The offers of different banks on the USD 10,000 loan may differ significantly. Thanks to the strong competition on the market, banks compete for customers by offering promotional interest rates or resigning from charging commissions for granting credit. Thanks to these measures, the APRSO for such a loan is quite low and the monthly repayment installment is easy to swallow. For a specific analysis, let us consider two loan repayment modes: in 12 and 24 monthly installments.

Loan for 12 installments – APR in such cases may vary from 10 to even 40%. The upper limit makes the loan unprofitable, because by borrowing from the bank we will have to give back 12000USDa monthly installment will be almost a thousand USD. In case of the best offer we will pay only a few hundred USD more and the installment will fall by more than 100 USD.

– In such cases, the APR may vary from 10 to even 40%. Upper limit makes the loan becomes unprofitable, because borrowing from the bank 10000USD we will have to give back 12000USDa monthly installment will be almost a thousand USD. In case of the best offer we will pay only a few hundred USD more and the installment will fall by more than 100 USD. Credit on 24 installments – If you repay such a credit within two years and using the services of the cheapest bank we will have to pay back 11000USD paying off every month almost 500 USD. If we use the most expensive offer, the instalment will be slightly higher and the bank will receive over 2000 USD more. Generally, the longer the repayment term, the more money we have to give to the bank. Therefore, as far as possible, we should conclude credit agreements for the shortest possible period of time.

What do we have to watch out for?

When submitting a loan application, let’s carefully check what the offer refers to. Sometimes it may happen that the bank will want to offer us additional credit insurance, which is not obligatory and may significantly affect the amount of the monthly installment. It is worth resigning from it already at the stage of submitting the application, because afterwards it will be possible only by sending a letter of resignation or visiting a bank outlet. And there is not always time.

Let’s also try to arrange the loan repayment in such a way that the monthly installment does not deplete our budget too much. If we are late with the payment of the instalment, we can go to the register of the office. The Credit Information company collects and makes available data on credits taken out by us. If we find ourselves in the database due to a delay in repayment, we may have a problem with obtaining another loan in the future. Similarly, it works the other way around. If we pay off our liabilities on an ongoing basis, the banks gain trust in us and can offer us better terms of repayment. So it is worth doing everything to timely pay off all liabilities. Lower monthly installment will certainly be helpful in this.

Is a quick loan a good solution?

We can use the momentums in case when we have received a negative response to the loan application from the bank. It does not matter whether it was due to insufficient creditworthiness of a given loan amount or due to a negative history in the office. Companies offering momentary loans look at it with a rather lenient eye and most of them will not even verify our earnings and history in the office. To grant a loan, all they need to do is provide their ID card details and confirm their identity. Of course, we have to take into account the much higher cost of such a loan. RRSO in the case of such momentary events may in extreme cases be even several thousand percent!

Credit 10 thousand